These mortgages adhere to Islamic legal guidelines, making certain that the transactions are free from interest (riba) and comply with Sharia principles. Such mortgages are completely different from conventional property loans as there is not any interest to pay as per Sharia Law. This kind of mortgage requires a minimal of 20% of the deposit amount. These mortgages are also identified as home purchase plans(HPP) that are further differentiated as Ijara(lease), Musharaka(partnership) and Murabaha(profit). The ijara construction is actually the same as diminishing musharakah, although with one main distinction – the amount the financial institution contributes to the property purchase isn’t decreased by the rent paid. For example, say somebody purchases a home for £200,000; they put down £40,000 as deposit and the stability of £160,000 is contributed by the financial institution.

These mortgages adhere to Islamic legal guidelines, making certain that the transactions are free from interest (riba) and comply with Sharia principles. Such mortgages are completely different from conventional property loans as there is not any interest to pay as per Sharia Law. This kind of mortgage requires a minimal of 20% of the deposit amount. These mortgages are also identified as home purchase plans(HPP) that are further differentiated as Ijara(lease), Musharaka(partnership) and Murabaha(profit). The ijara construction is actually the same as diminishing musharakah, although with one main distinction – the amount the financial institution contributes to the property purchase isn’t decreased by the rent paid. For example, say somebody purchases a home for £200,000; they put down £40,000 as deposit and the stability of £160,000 is contributed by the financial institution.

Affording A Mortgage

You can plan to study abroad, discover a new job out of state, or simply pick up and go simply because you’ll find a way to without having to attend to sell the house. Are you ready to buy a house and live the upcoming years of life on this house? Are you committed to living in this metropolis for the foreseeable future?

Issue – Best Prepared Meal Supply Service

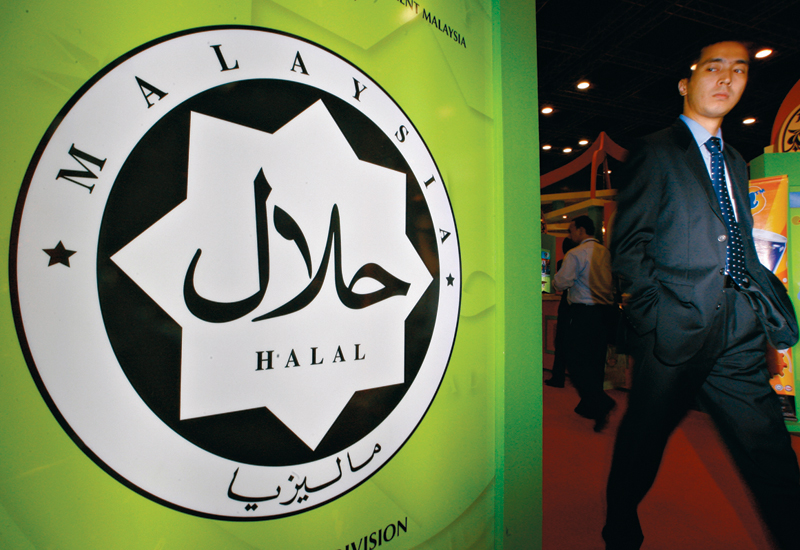

Instead, the financial institution will buy the property and sell it back to you for a better price. A Halal mortgage is a type of home financing that complies with Islamic regulation, which prohibits the fee of interest. Instead of charging interest, monetary establishments make a revenue via other arrangements like rent or profit-sharing. Key features embody risk-sharing between the bank and borrower, and investments that are backed by tangible belongings. Sharia Home Loans Australia is a kind of no-interest home purchase plan which Muslims can choose as they’re permissible in Islam. It works very simply as the financial institution buys the property for the client and the consumer pays them in type of rent for a particular time period.

- The financial institution does not charge interest, as this is not allowed in Islamic finance, but as a substitute charges rent on the a part of the property that the client doesn’t yet own.

- All of our content is written or verified by certified advisors from the front line.

- In a nutshell, this sort of Islamic mortgage is the Sharia-compliant equivalent of a repayment mortgage.

- Mortgage suppliers providing Ijara contracts should adhere to the guidelines set forth by regulatory bodies just like the Financial Conduct Authority to ensure compliance with moral and authorized standards.

- This technique is believed to make the meat cleaner, healthier, and extra humane, leading to higher taste, improved meals safety, and moral consumption.

Pay with a DBS/POSB, UOB or BIBD bank card to get 15% off your meals bill at Carousel from now until 30 Dec 2024. You can use up to 3 completely different playing cards for as a lot as 10 individuals per card. People typically think that buying is probably the most smart monetary determination.

After buying a portion of the property with their initial deposit, the purchaser of the property pays regular instalments to the bank, overlaying rent for the portion they do not own and an acquisition payment. In this way, a customer gradually buys the property from the bank and finally turns into the only real proprietor. The diminishing musharakah structure is probably the most well-known construction within the UK, and if you’re taking out a Home Purchase Plan, you’ll very likely be using this structure. Under this structure, the customer and the Islamic bank buy the property mutually, with the client contributing a deposit and the financial institution providing the rest.